2019 Jeep Wrangler Diminished Value Case Study (PDF)

If you are looking for an SUV that can handle punishing off-road conditions, the 2019 Jeep Wrangler is a good choice. It has a tough solid-axle suspension, big all-terrain tires, and a sturdy four-wheel-drive system.

As a weekend cruiser, the Wrangler is great, but as a daily driver, it’s less appealing. It gets poor fuel economy, its ride quality can be harsh over rough pavement, and its projected ownership costs are higher than the average for a compact SUV. There’s something for everyone in the 2019 Jeep Wrangler, as long as you don’t prioritize an extremely quiet cabin or smooth ride.

The standard 285-hp 3.6-liter V-6 from the previous-generation Wrangler makes its way under the hood of the new JL and can be paired with a six-speed manual gearbox or an eight-speed automatic transmission. Optionally, a turbocharged four-cylinder engine is paired with an electric motor to provide additional power at the low end. Part-time four-wheel drive is standard across the Wrangler range and can be controlled by a lever on the console.

A Wrangler can be equipped with only the essentials or can be loaded up with modern infotainment goodies. Its infotainment interface—called Uconnect—is simple to use, quick to respond to, and can be displayed on a touchscreen available in three sizes. Navigation and a nine-speaker Alpine audio system are optional, as are Apple Car Play and Android Auto.

Did You Crash Your 2019 Jeep Wrangler?

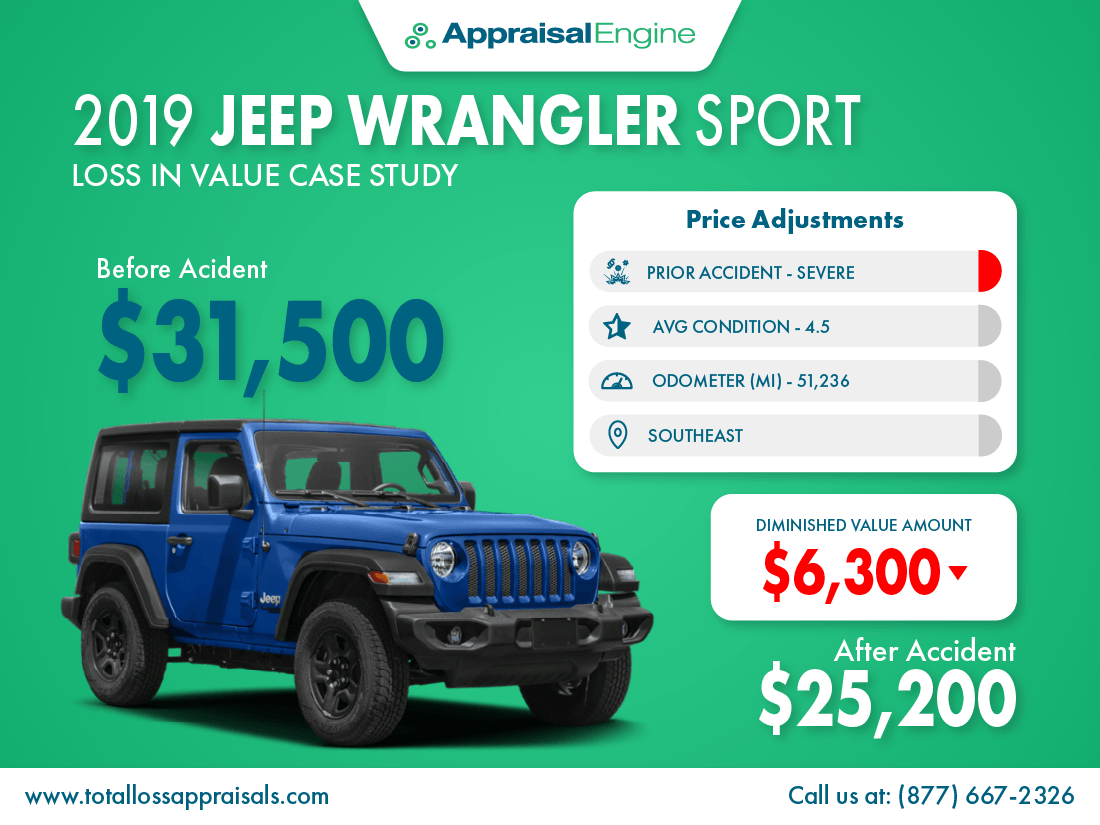

Your day was like any other, you were minding your own business when you suddenly had a car accident. Did you know that a wrecked and repaired car can lose over $6,300 in value?

| Diminished Value Calculator | |

| Before Accident Cash Value | $31,500 |

| After Accident Cash Value | $25,200 |

| Diminished Value | $6,300 |

No matter who was at fault, you’re entitled to diminished value. Would you like to know how much your car lost due to a collision? Get a FREE Claim Review or call us now at (877) 667-2326 and get the money you deserve.

Licensed Auto Appraisers specializing in Diminished Value, Total Loss, Actual Cash Value, Classic Cars, and Insurance Claim Settlements. Don’t accept the insurance company’s offer before talking to us, we can often help you get more money!