2020 Subaru Outback Diminished Value Case Study (PDF)

The 2020 Subaru Outback is categorized as a midsize SUV based on its dimensions, but it has a distinct wagon appearance when viewed from the side. Despite this, it is an incredibly capable, versatile, and comfortable vehicle in its class.

The Outback is driven by two engines: a 2.5-liter 4-cylinder boxer and a 2.4-liter turbocharged engine. Because it’s more powerful and has better fuel economy than the Outback’s older 6-cylinder engine, the turbocharged engine is a great option. Both engines are factory equipped with a Continuously Variable Automatic Transmission (CVT).

In addition to standard safety features like adaptive cruise control and forward collision warning with automatic braking, the Outback now comes with an advanced DriverFocus system that detects distractions or sleepiness using an infrared monitor. As soon as you get in, the system will scan your face and set the seat and mirrors according to your preferences.

According to the EPA, the standard 2020 Outback earns 33 mpg on the highway and 26 mpg in the city. Its turbocharged version earns 30 mpg on the highway and 23 mpg in the city.

This Outback is excellent. The seats are comfortable, the cargo space is excellent, and the features are plentiful.

Did You Crash Your 2020 Subaru Outback?

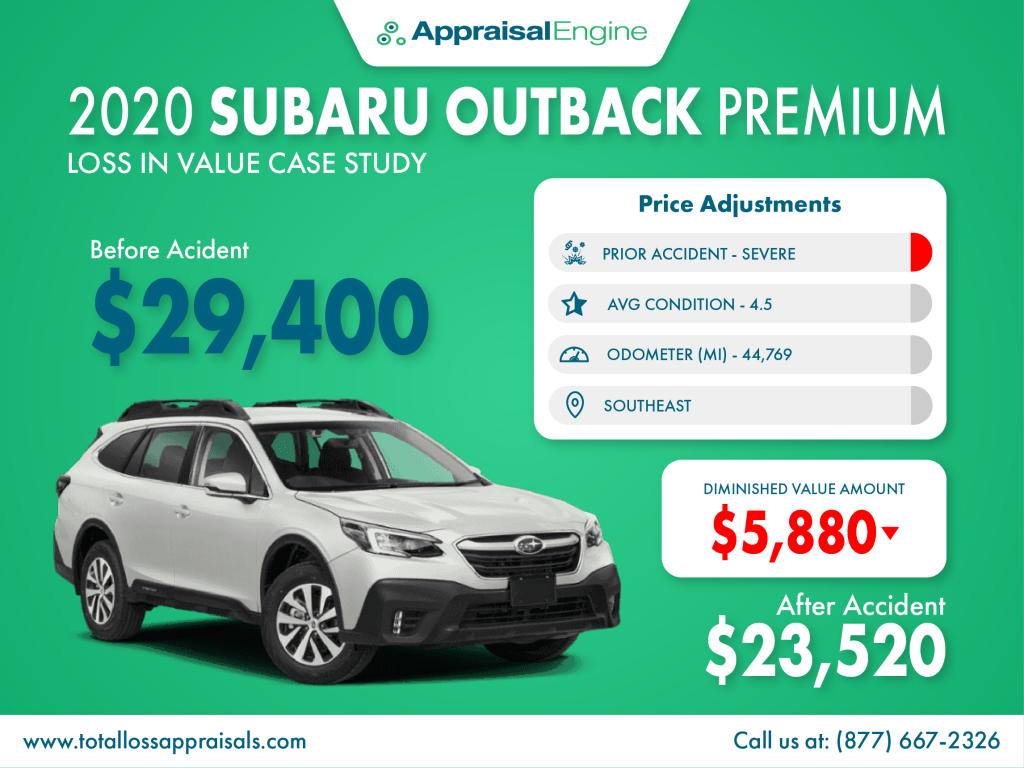

Your day was like any other, you were minding your own business when you suddenly had a car accident. Did you know that a wrecked and repaired car can lose over $5,880 in value?

| Diminished Value Calculator | |

| Before Accident Cash Value | $29,400 |

| After Accident Cash Value | $23,520 |

| Diminished Value | $5,880 |

No matter who was at fault, you’re entitled to diminished value. Would you like to know how much your car lost due to a collision? Get a FREE Claim Review or call us now at (877) 667-2326 and get the money you deserve.

Licensed Auto Appraisers specializing in Diminished Value, Total Loss, Actual Cash Value, Classic Cars, and Insurance Claim Settlements. Don’t accept the insurance company’s offer before talking to us, we can often help you get more money!