2023 Hyundai Elantra Diminished Value Case Study (PDF)

The 2023 Hyundai Elantra is a versatile and attractive compact sedan that offers a lot of value for its price point. With a variety of engine options, including a fuel-efficient hybrid, and an array of features, it stands out in a competitive market. If you’re in the market for a small sedan, the Elantra is definitely worth considering.

The SE and SEL models of the 2023 Hyundai Elantra come equipped with a standard 2.0-liter four-cylinder engine that delivers a modest 147 horsepower and 132 pound-feet of torque. For those seeking a more spirited driving experience, the N Line model offers a smaller 1.6-liter turbocharged engine that packs a punch with 201 horsepower and 195 pound-feet of torque.

The 2023 Hyundai Elantra is quite spacious and provides great visibility in the front seat and plenty of legroom in the back, making it one of the roomiest cars in its class. Taller people may have headroom issues, but generally, it’s very comfortable. The Limited trim level comes with a pair of screens for gauges and infotainment, which has an intuitive user interface with straightforward directions. Another nice feature is that both Apple CarPlay and Android Auto are wireless, though you do need to use a cord for integration on the larger 10.25-inch screen.

Did You Crash Your 2023 Hyundai Elantra?

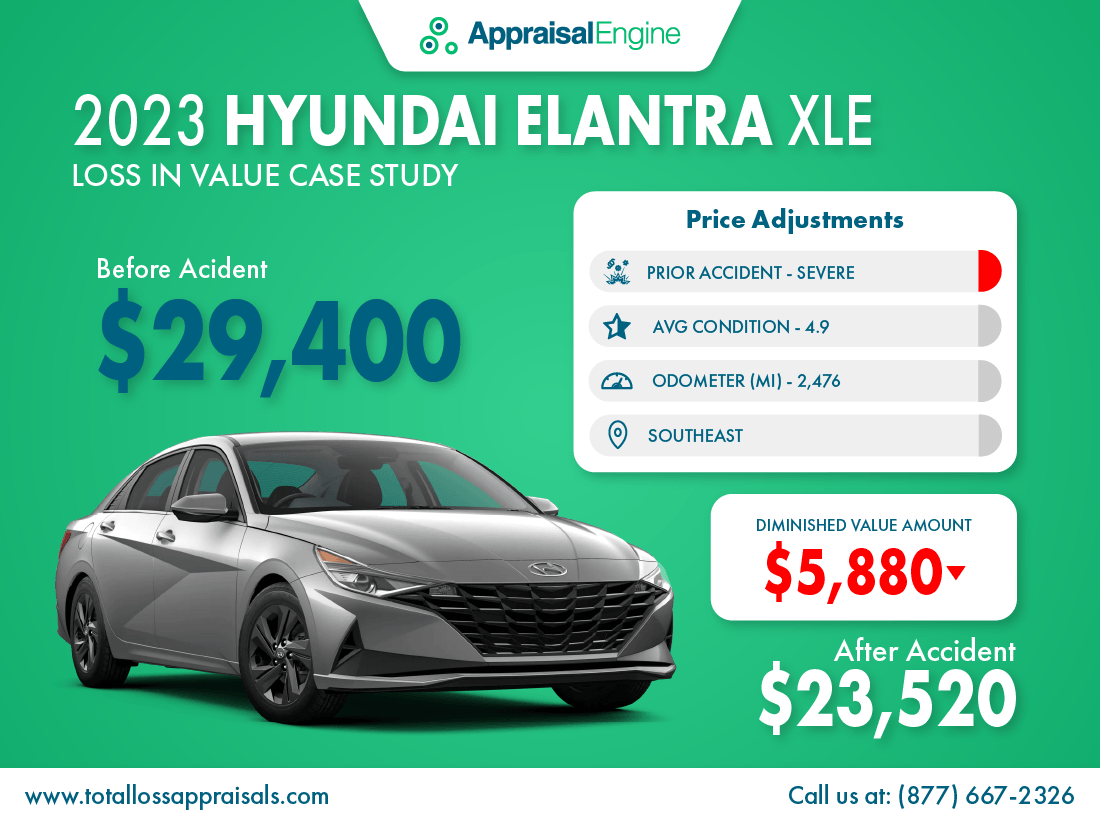

Your day was like any other, you were minding your own business when you suddenly had a car accident. Did you know that a wrecked and repaired car can lose over $5,880 in value?

| Diminished Value Calculator | |

| Before Accident Cash Value | $29,400 |

| After Accident Cash Value | $23,520 |

| Diminished Value | $5,880 |

No matter who was at fault, you’re entitled to diminished value. Would you like to know how much your car lost due to a collision? Get a FREE Claim Review or call us now at (877) 667-2326 and get the money you deserve.

Licensed Auto Appraisers specializing in Diminished Value, Total Loss, Actual Cash Value, Classic Cars, and Insurance Claim Settlements. Don’t accept the insurance company’s offer before talking to us, we can often help you get more money!