Breaking China’s Grip on Electric Cars: Us Efforts (PDF)

On Friday, the U.S., a global laggard in electric vehicle sales, announced new rules aimed at reducing its dependence on China, a move that could raise Tesla prices.

The European Union has also released its own set of guidelines to boost EV usage in the second-largest EV market after China. The guidelines include banning gas-powered cars by 2035, which has rocked the global industry, given that sales rose 65% last year to 10.2 million autos.

An electric vehicle will qualify for half of the $7,500 subsidy if it meets a government-set threshold for sourcing and processing critical minerals used in EV batteries under the new U.S. regulations. As of this year, 40% of an electric vehicle’s battery must be extracted and processed in the U.S. or recycled in North America, with the limit increasing by 10% a year until it reaches 80% by 2027.

EVs can qualify for the other half of the tax credit if 50% of their battery components are manufactured or assembled in North America, with that percentage increasing to 100% by 2029. When the new rules take effect on April 18, Tesla has already confirmed the $7,500 credit for Model 3 rear-wheel drives will disappear.

China’s Dominance in the Electric Vehicle Market

Despite the efforts of U.S. and European regulators, China remains the world’s dominant electric vehicle market, with Chinese car manufacturers leading the way. Since General Motors introduced its first plug-in hybrid car in 2010, and Nissan introduced the first all-electric LEAF, U.S. carmakers have jumped on the electric bandwagon.

The world’s largest electric vehicle manufacturer is Tesla, but seven of the top brands are in China, led by BYD Co. and Wuling Motors. Government incentives have helped power European sales, with behemoths such as Volkswagen, Stellantis, and BMW dominating the market.

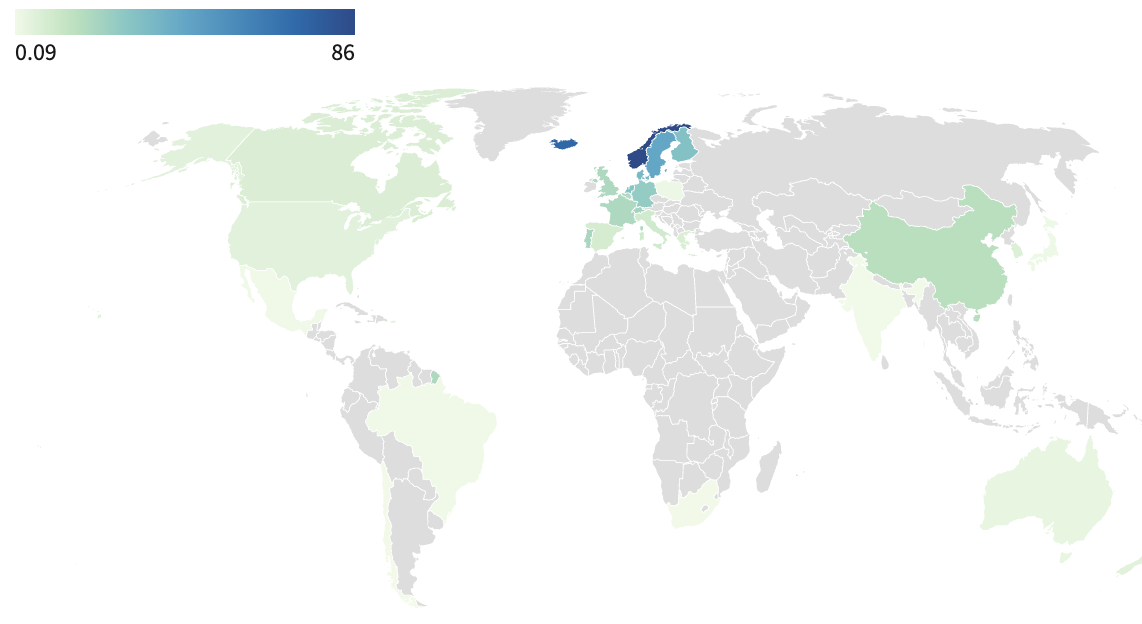

In 2022, China saw 6.5 million EV sales in the form of battery EVs and plug-ins hybrids, which was roughly equal to 26% of the total number of new passenger cars sold. Compared to 2021, this figure was nearly doubled. Globally, China accounted for an impressive 59% share in EV sales volume last year. As per Dutch bank ING forecasts, by 2025 13% of vehicles on China’s roads will be electric up from 5% recorded in 2022. Even more ambitiously, by 2030 ING envisions that 50% of China’s auto sales will be EVs – five years before the target date set by the country’s government.

It is estimated that nearly 100 Chinese EV makers offer nearly 300 models between $5,000 and $90,000, including NIO Inc., Guangzhou Automobile Group, Geely Auto, and Xpeng Inc. EV sales, however, are expected to slow next year unless China extends its EV subsidies. EV sales are expected to rise by just 8% to 28%.

Counterpoint reported that in 2022, China was the leading EV market in the world. However, Japan had the fastest growth rate with a staggering 119%, surpassing China. Despite this, the International Energy Agency’s data from 2021 reveals that only 1% of new car sales in Japan were EVs, whereas South Korea’s new car sales comprised of 8% EVs.

As per ING’s projections, the European market is expected to witness a significant surge in EV sales. In 2023, 26% of new car sales in Europe will likely be electric, with China closely following with 28%. Nonetheless, the EV market growth isn’t uniform across Europe, with some nations, such as Germany, still lagging behind.