Facing a car total loss situation can be daunting and confusing, especially when you don’t know where to start.

When your vehicle is declared a total loss, it’s not just about dealing with the immediate aftermath but understanding the entire process.

This article delves into the hidden truths about car total loss, shedding light on the crucial steps and what most websites don’t tell you about handling this challenging scenario.

The History and Evolution of Car Total Loss

Early Beginnings

The concept of car total loss has evolved significantly over the years. In the early days of the automotive industry, there were no standardized methods for assessing vehicle damage after an accident. As cars became more prevalent, insurance companies needed a way to determine when a vehicle was beyond economical repair.

Standardization and Modern Practices

In the 1930s, the term “total loss” began to be used by insurance companies to describe vehicles that were too damaged to justify repair costs. By the 1960s, more concrete guidelines were established, comparing repair costs to the vehicle’s actual cash value (ACV). If repair costs exceeded a certain percentage of the ACV, the vehicle was declared a total loss. Today, most insurance companies use a threshold of 70-75% of the ACV to make this determination.

Evolving Regulations in Car Total Loss

Regulations and practices continue to evolve. Technological advancements have significantly improved the accuracy of total loss assessments. Tools like computerized estimating systems and data analytics help insurers make more precise calculations, benefiting both the company and the policyholder.

What Does Car Total Loss Mean?

When a car is declared a total loss, it means the cost to repair the vehicle exceeds a certain percentage of its actual cash value (ACV).

This percentage varies by insurer but is typically around 70-75%.

Essentially, repairing the vehicle is not economically feasible, so the insurer pays the ACV minus any deductible instead.

“Total loss is a financial decision more than a mechanical one.” says Jane Smith, an auto insurance expert at Car Insure Pro.

“It’s about balancing the cost of repairs against the vehicle’s value.”

Steps to Take When Your Car Is Declared a Total Loss

1. Confirm the Total Loss Determination

First, ensure the insurance company has accurately assessed the damage. You can request a copy of the repair estimate and the ACV calculation. If you disagree with the assessment, consider getting a second opinion.

2. Understand Your Car Total Loss Payout

The insurer will pay you the ACV of your vehicle minus any deductible. Ensure you understand how the ACV was determined. “It’s crucial to know the details of your payout to avoid surprises,” advises John Doe, a claims adjuster with Auto Protect.

3. Settling Loans and Liens

If you have an outstanding loan on the vehicle, the insurance payout will go to the lender first. Any remaining balance after the loan is paid off will be given to you. If the payout does not cover the loan balance, you will be responsible for the difference.

4. Return the Vehicle and Keys

You will typically need to return the vehicle and keys to the insurer or a designated salvage yard. Make sure to remove all personal belongings from the car.

5. Shopping for a Replacement After a Car Total Loss

Once the settlement is complete, you can begin shopping for a replacement vehicle. Use the payout as a down payment or full payment for your new car, depending on the amount you received.

How is the Actual Cash Value (ACV) of a Car Determined?

The actual cash value (ACV) of your car is crucial in determining whether it’s declared a total loss.

Insurance companies use various factors to calculate the ACV, including the car’s age, mileage, condition, and market value.

According to “Total Loss in Automobile Insurance: An Empirical Analysis,” the ACV is derived from a combination of market surveys and historical data on vehicle sales.

The study emphasizes that accurate ACV calculations are essential for fair settlements.

Calculating Car Total Loss: A Step-by-Step Guide

Understanding how a total loss is calculated can help you navigate the process more effectively.

Here’s a breakdown of the factors involved:

Formula

Total loss calculation typically involves comparing the repair costs plus the salvage value to the vehicle’s actual cash value (ACV).

If the total exceeds the insurer’s threshold (usually around 70-75% of the ACV), the car is declared a total loss.

Formula:

Total Loss = Repair Costs + Salvage Value > ACV × Insurance Threshold

Example

Imagine your car’s ACV is $15,000, and the insurance company’s threshold is 75%.

If the repair costs plus salvage value exceed $11,250 (75% of $15,000), the vehicle will likely be declared a total loss.

Factors Affecting Calculation

- Repair Costs: Detailed estimates from repair shops.

- Salvage Value: The amount the damaged car can be sold for in its current state.

- Insurance Threshold: The percentage of the ACV that determines a total loss, varying by insurer.

“Understanding the total loss calculation helps policyholders anticipate and verify their insurer’s assessment.” says Loretta Worters, Vice President of Media Relations at the Insurance Information Institute (III).

What Happens if a Policyholder Disagrees with the Insurance Company’s ACV Assessment?

Disagreements between policyholders and insurers over the ACV are not uncommon.

If you believe your car is worth more than the insurer’s estimate, you have the right to dispute the valuation.

Salvatore Giunta:

“Always gather evidence such as recent maintenance records, upgrades, and comparable sales in your area to support your case.

A second opinion from an independent appraiser can also be beneficial.”

Total Loss Appraisal: Ensuring Fair Compensation

This is where professional appraisal services come into play.

A total loss appraisal can offer a thorough, unbiased assessment of your vehicle’s value, ensuring you get the settlement you deserve.

“Getting an independent appraisal can often uncover hidden value in your vehicle that the insurance company might overlook.”

– Robert Hunter, Director of Insurance at the Consumer Federation of America (CFA).

Imagine having peace of mind, knowing that you’ve received a fair and accurate valuation for your totaled car.

With professional appraisers from Total Loss Appraisals, this is possible.

Unlike many competitors, we offer a flat fee for our services, ensuring transparency and no hidden costs.

Plus, our service fee is only $225, making it one of the most affordable options available.

A study by the Federal Reserve found that independent appraisals could increase settlement amounts, giving you more funds to put towards a replacement vehicle.

“Don’t settle for less.”

Visit Total Loss Appraisals to schedule your appraisal today and ensure you receive the compensation you deserve.

Impact of Aftermarket Parts on a Car’s ACV

Aftermarket parts can influence your car’s ACV, often reducing it due to potential concerns about quality and compatibility.

“Total Loss in Automobile Insurance: An Empirical Analysis” highlights that while aftermarket parts can enhance a vehicle’s performance or aesthetics, they typically don’t add significant value from an insurance perspective.

Original manufacturer parts usually maintain the vehicle’s value better.

Regional Differences in Car Total Loss Regulations and Practices

Total loss regulations and practices can vary significantly by region.

Understanding these differences can help you navigate the claims process more effectively.

“Automobile Insurance and Compensation Policies: An International Comparison” shows that different countries and even states within the U.S. have unique guidelines for assessing total loss.

For instance, some regions might use different thresholds or have specific laws governing the use of salvage titles.

Car Total Loss Regulations and Practices in Georgia

In Georgia, the total loss threshold is set at 75% of the vehicle’s actual cash value (ACV).

This means that if the cost of repairs exceeds 75% of the ACV, the vehicle is declared a total loss.

Additionally, Georgia law requires that any vehicle declared a total loss must receive a salvage title.

This title must be clearly indicated when selling the vehicle in the future.

“In Georgia, it’s crucial for policyholders to be aware of the 75% threshold.

Many are surprised when their vehicles are declared total losses despite what seems like repairable damage.”

– Robert Hunter

Car Total Loss Regulations and Practices in North Carolina

North Carolina has a slightly different approach.

The state uses a total loss threshold of 75% of the ACV, similar to Georgia.

However, North Carolina law also allows insurers to consider other factors such as the vehicle’s age and condition.

If a vehicle is declared a total loss, it will receive a salvage title, but the state has specific guidelines on how these vehicles can be repaired and re-titled for road use.

“North Carolina’s regulations provide more flexibility for insurers, which can sometimes benefit the policyholder.

Understanding these nuances can help you better navigate a total loss claim in the state.”

– Salvatore Giunta, Senior Claims Adjuster at GEICO.

Common Mistakes to Avoid When Handling a Car Total Loss Claim

Navigating a car total loss claim can be complex, and it’s easy to make mistakes that can cost you time, money, and frustration. Here are some common pitfalls to avoid:

1. Not Thoroughly Understanding Your Insurance Policy

Many policyholders don’t fully understand the details of their insurance coverage until they need to file a claim. It’s crucial to know what your policy covers and the limits of your coverage.

Robert Hunter, Director of Insurance at CFA:

“One common mistake is not thoroughly understanding the terms of your policy.

Another is failing to document the condition of your vehicle with photos and maintenance records before an accident occurs.

Being proactive can make a significant difference.”

2. Failing to Document the Vehicle’s Condition

Before an accident occurs, it’s a good idea to keep a detailed record of your vehicle’s condition.

This includes photos, maintenance records, and any modifications or upgrades.

Take photos of your car from multiple angles and keep receipts for any work done.

These records can be invaluable if you need to dispute the insurance company’s valuation.

3. Accepting the First Settlement Offer

Insurance companies may try to settle quickly with a low initial offer.

It’s important to ensure the settlement is fair and reflects the actual value of your vehicle.

Research your car’s market value using tools like Kelley Blue Book and get a second opinion from an independent appraiser if needed.

“You have the right to negotiate a fair settlement.” – Salvatore Giunta.

4. Overlooking the Need for a Second Opinion

Sometimes, the insurance company’s assessment of your car’s value may not be accurate.

Getting a second opinion can ensure you receive a fair payout.

Consider hiring an independent appraiser, especially if you’ve made significant upgrades to your vehicle or kept it in exceptional condition.

5. Not Considering All Potential Payouts

In addition to the actual cash value (ACV) of your car, you might be entitled to other compensation, such as for loss of use or personal items damaged in the accident.

Review your policy and discuss with your insurance agent what additional payouts you might be eligible for.

6. Ignoring the Importance of Gap Insurance

If you owe more on your car loan than the vehicle’s ACV, gap insurance can cover the difference.

Without it, you might still owe money on a totaled car.

Consider adding gap insurance to your policy, especially if you’re financing a new vehicle.

“Gap insurance can be a financial lifesaver”, notes financial advisor Jane Doe.

7. Not Preparing for Higher Insurance Premiums

A total loss claim can affect your future insurance premiums, making it more expensive to insure your next vehicle.

Shop around for insurance quotes from multiple companies to find the best rate.

Being a cautious and informed consumer can help you save money in the long run.

8. Failing to Remove Personal Items from the Vehicle

It’s easy to forget personal items left in a totaled vehicle, but once the car is handed over to the insurance company or a salvage yard, retrieving them can be difficult.

Thoroughly check your car for any personal belongings before surrendering it.

Items often forgotten include garage door openers, sunglasses, and important documents.

9. Not Understanding the Impact on Your Credit

If the insurance payout doesn’t cover your car loan, you may still owe money, which can affect your credit score if not handled properly.

Talk to your lender about options if your loan balance exceeds the insurance payout.

They may offer solutions such as refinancing or loan modification.

10. Overlooking State-Specific Regulations

Each state has its own regulations and practices regarding total loss claims.

Failing to understand these can lead to missteps in the claims process.

Research your state’s specific regulations or consult with a local attorney to ensure you comply with all requirements.

For example, total loss regulations in Georgia and North Carolina have unique guidelines that can significantly impact your claim.

By avoiding these common mistakes and being proactive, you can navigate the car total loss claims process more effectively and secure the best possible outcome.

Some Car Total Loss Statistics

Understanding the prevalence and impact of car total loss can help you navigate this challenging situation more effectively.

Here are some key statistics:

- According to the National Association of Insurance Commissioners (NAIC), around 14% of auto insurance claims result in a total loss.

- A study by CCC Information Services found that the average value of a totaled vehicle in 2021 was approximately $10,000.

- The Insurance Research Council (IRC) reported that 20% of all vehicles involved in accidents were declared total losses in 2020.

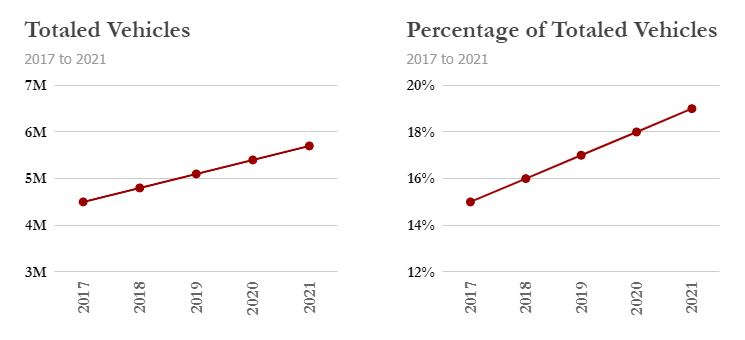

Increasing of Totaled Vehicles Graphs:

This chart illustrates the percentage and estimated total number of vehicles declared a total loss from 2017 to 2021. The steady increase in total loss claims underscores the importance of understanding total loss procedures and their financial implications.

Lesser-Known Facts About Car Total Loss

Salvage Titles

When a vehicle is declared a total loss, it often receives a salvage title. This indicates that the car has been significantly damaged and repaired. Vehicles with salvage titles can be more challenging to insure and resell.

How to Negotiate the ACV in a Car Total Loss

Many policyholders don’t realize that they can negotiate the ACV with their insurer. If you believe your vehicle is worth more than the insurer’s estimate, provide documentation like recent maintenance records, upgrades, and comparable sales to support your case.

Impact on Insurance Rates

Having a total loss claim can impact your future insurance rates. Insurers may view you as a higher risk, which can lead to increased premiums. It’s essential to shop around and compare quotes to find the best rate.

Handling a Car Total Loss in Lease Agreements

If you’re leasing a vehicle, a total loss can complicate matters. You will need to pay off the remaining lease balance, which may exceed the insurance payout. Gap insurance can help cover this difference, so it’s worth considering if you lease a car.

Understanding and Handling a Car Total Loss

Understanding car total loss is crucial for navigating the aftermath of a severe accident.

By knowing what total loss means, its history, and the steps to take, you can manage the situation more effectively and make informed decisions.

Whether it’s negotiating your payout or finding a replacement vehicle, being well-informed can save you time, money, and stress.

Are you ready to handle a total loss claim with confidence?