Diminished Value Case Study For 2019 Ford F-150 with Severe Damage (PDF)

It’s no accident that the 2019 Ford F-150 is one of the most popular trucks on the market. The F-150 is one of the best full-size pickup trucks available today, with a wide range of trim levels, multiple powertrains, and huge towing and hauling capabilities.

Aside from being a tough pickup truck, the F-150 is also versatile enough for family duty. Sync 3’s infotainment system connects you to your smartphone, while advanced driver safety aids keep you safe. The interior is modern and comfortable with many high-class features. An automatic brake with a forward collision warning is standard on every F-150.

The F-150 has six engines available, including a basic V6 and a turbocharged V6 with 450 horsepower. Of course, if you’re looking for trailer-pulling power, the F-150 has you covered. As part of the six-engine lineup, the F-150 now offers a 3.0-liter diesel engine. When it comes to towing power, it’s probably the best option, but its significant price increase must be taken into consideration.

Did You Crash Your 2019 Ford F-150?

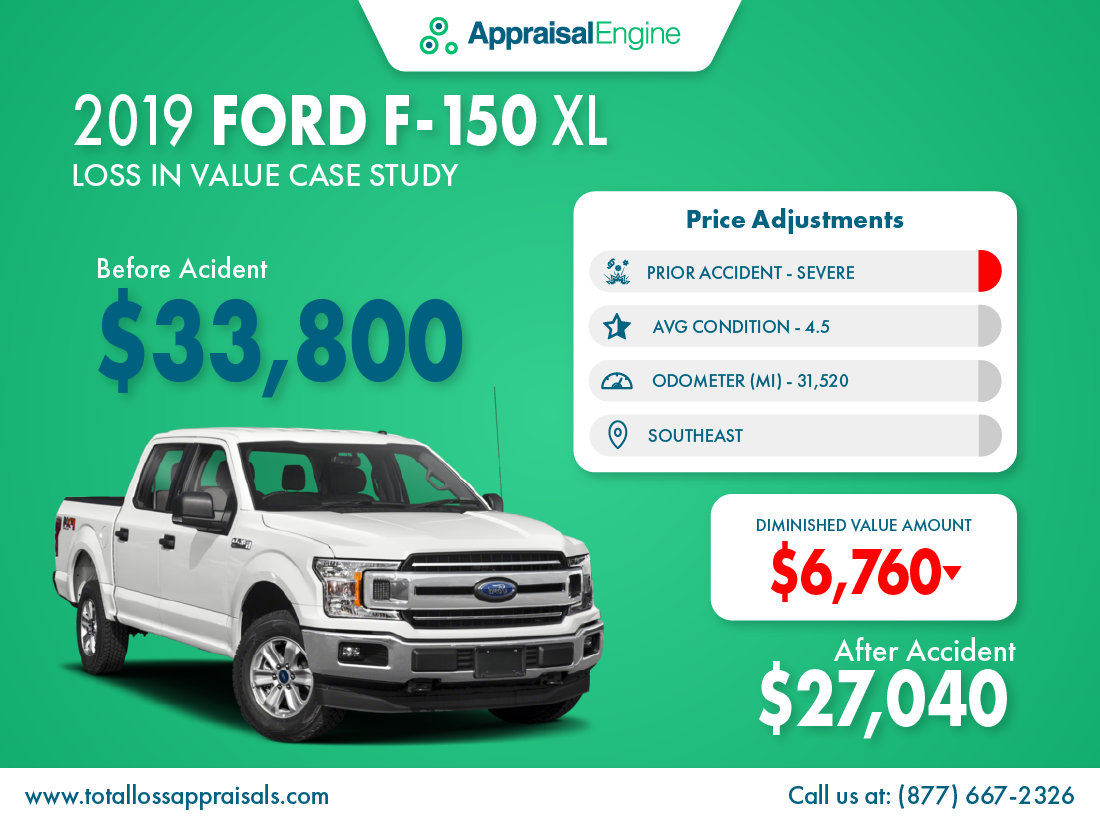

Your day was like any other, you were minding your own business when you suddenly had a car accident. Did you know that a wrecked and repaired car can lose over $6,760 in value?

| Diminished Value Calculator | |

| Before Accident Cash Value | $33,800 |

| After Accident Cash Value | $27,040 |

| Diminished Value | $6,760 |

No matter who was at fault, you’re entitled to diminished value. Would you like to know how much your car lost due to a collision? Get a FREE Claim Review or call us now at (877) 667-2326 and get the money you deserve.

Licensed Auto Appraisers specializing in Diminished Value, Total Loss, Actual Cash Value, Classic Cars, and Insurance Claim Settlements. Don’t accept the insurance company’s offer before talking to us, we can often help you get more money!