Gap Insurance: What Is It and How Does It Work? (PDF)

What Is?

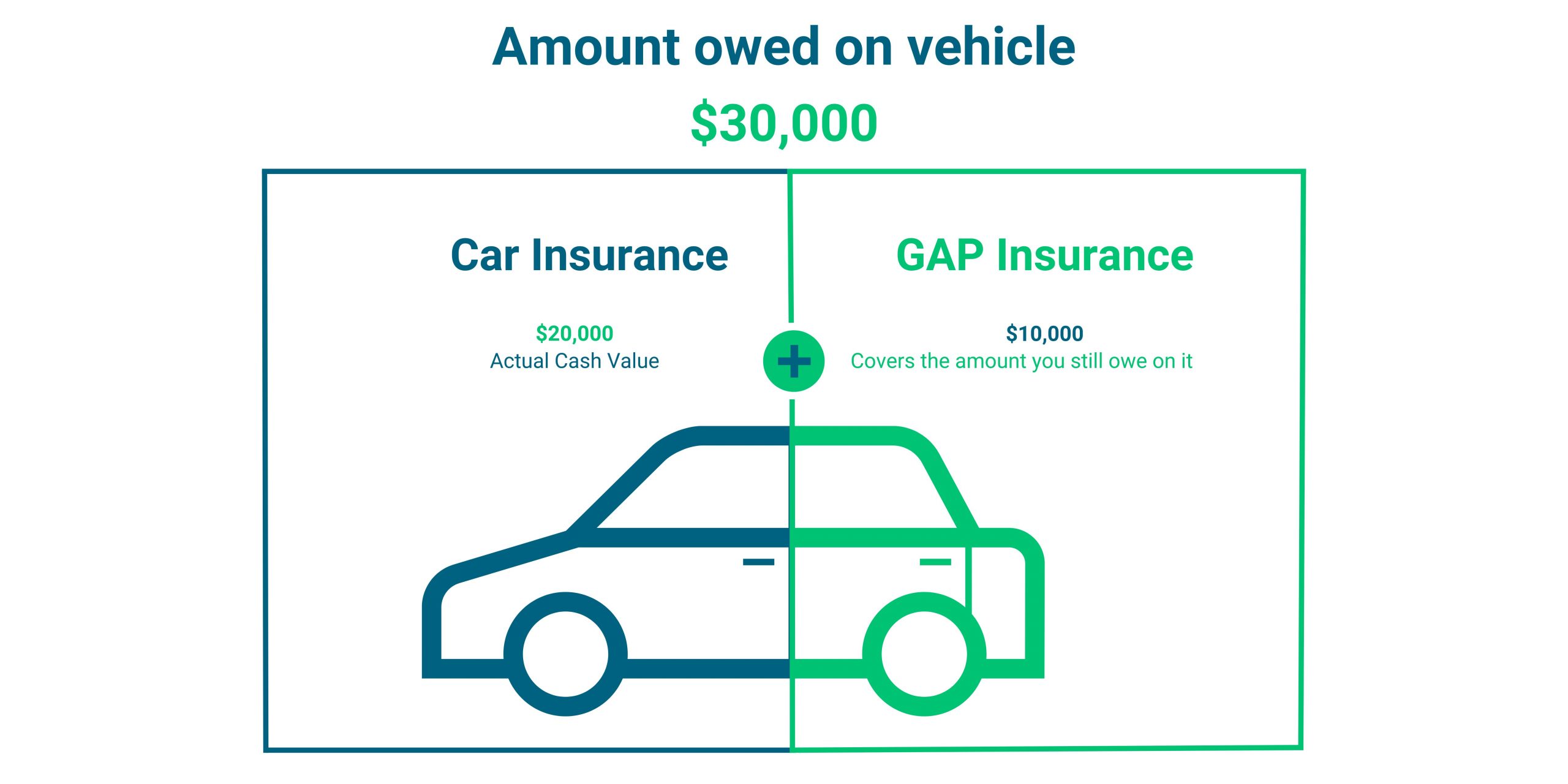

Adding gap insurance to your auto insurance policy covers the difference between the depreciated value of your car and your loan or lease balance. Standard insurance policies will only cover the current market value of your car should it be totaled or stolen. You may end up in financial trouble if you owe more than the car is worth. Gap insurance covers the difference, ensuring you don’t get saddled with an expensive loan.

Understanding When Gap Insurance Is Essential

Becomes crucial in various scenarios, including:

- Making a down payment of 20% or less, leaving you “upside down” in your loan from the start.

- Financing your car for an extended period, such as 60 months or more, leads to a significant loan balance even when the car’s value depreciates.

- Choosing a new car with a rapid depreciation rate, where the loan reduction lags behind the declining car value.

A Real-Life Example

Consider John, who bought a car worth $25,000 and financed it with a loan of $30,000. Unfortunately, the car gets stolen when it’s worth $20,000. John’s insurance policy pays him $20,000, but he’s still left with $10,000 in outstanding debt. This is where Gap Insurance shines, as it would cover the remaining $10,000, saving John from financial distress.

How and Where to Obtain Gap Insurance

If your vehicle is less than two to three years old and you are the original owner, you can add gap insurance to your existing policy. If you prefer, you can purchase gap insurance with your dealership or lender, but be aware of the added costs. To explore affordable options, Total Loss recommends talking to your insurance provider.

Evaluating Gap Insurance

As an esteemed Total Loss service provider, Total Loss understands the significance of protecting your investment in unforeseen circumstances. Gap insurance serves as a safety net when you owe more on your car than its actual value, providing you peace of mind and financial security. Whether you lease a vehicle or have a loan, Gap Insurance can be a game-changer. Contact Total Loss today to explore our comprehensive solutions and safeguard your investment. Don’t let a total loss leave you in a financial mess – trust Total Loss to protect you. Get a FREE Claim Review or call us now at (877) 667-2326 and get the money you deserve.

Licensed Auto Appraisers specializing in Diminished Value, Total Loss, Actual Cash Value, Classic Cars, and Insurance Claim Settlements. Don’t accept the insurance company’s offer before talking to us, we can often help you get more money!