June Auto Inventory Trends: Unveiling Market Shifts (PDF)

The automotive industry has been experiencing notable shifts in inventory trends, as dealers grapple with the aftermath of the pandemic and face new challenges in meeting consumer demand. In this article, we will explore the key inventory trends observed in June, highlighting both the struggles and successes of various automakers. From the intensifying competition in the compact luxury utility vehicle segment to the rise of non-Tesla electric vehicles (EVs), and the battle for dominance in the full-size pickup market, the landscape is evolving rapidly. Join us as we delve into the fascinating world of June auto inventory trends.

Compact Luxury Utility Vehicle Dogfight

The competition among European-brand luxury compact SUVs is heating up, with some notable players experiencing significant inventory fluctuations. While the Audi Q5’s inventory has seen a sharp rise, the redesigned 2023 Mercedes-Benz GLC is slowly recovering from a sell-down phase. BMW X3 inventories, on the other hand, remain stable, and Volvo’s XC60 presents an opportunity for conquest during the summer-sale season.

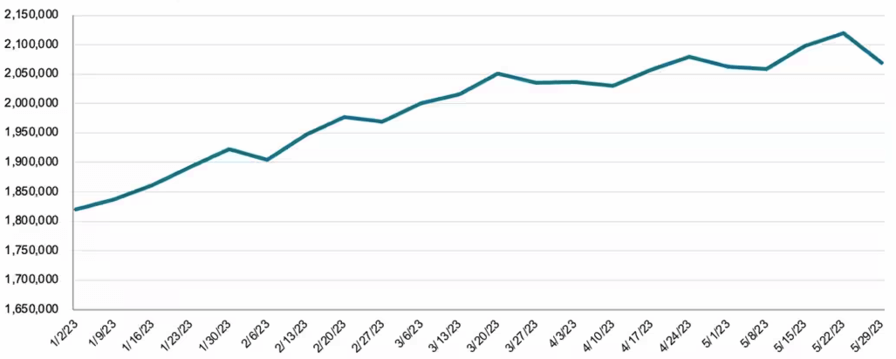

Total Advertised Industry

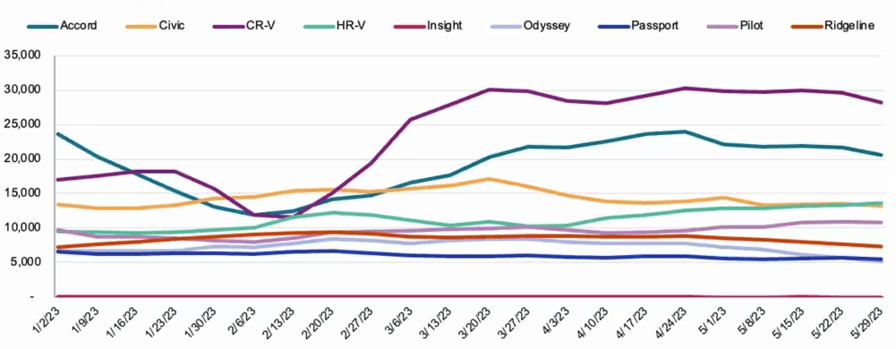

Honda CR-V and Accord Launches

The launch of redesigned models for the Honda CR-V crossover and Accord sedan led to temporary inventory shortages. However, the situation is quickly improving, with CR-V inventories bouncing back to a healthy level of nearly 30,000 units and the Accord reaching approximately 22,000 units. This recovery allows consumers to enjoy a wider range of options on showroom floors.

Honda Model Inventory

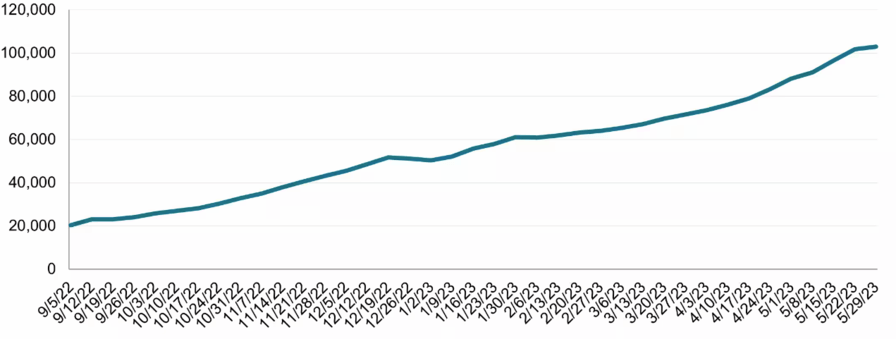

Non-Tesla EVs Entering the Fray

The electric vehicle market is experiencing a surge, not only due to Tesla but also with legacy brands making their mark. Non-Tesla battery-electric vehicles (BEVs) have witnessed a remarkable five-fold increase in inventory over the past nine months, reaching more than 100,000 units. Notably, around 30% of this inventory is concentrated in California, where the electrified market share is rapidly growing.

Total non-Tesla BEV Advertised Inventory

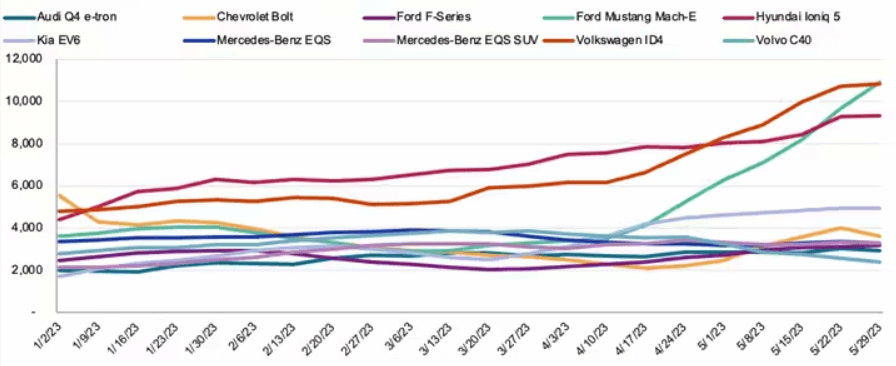

Hyundai and Ford Leading the EV Inventory

Hyundai and Ford have emerged as frontrunners in the EV segment, with Hyundai initially holding the most EVs in dealer-advertised inventory. However, Ford swiftly overtook Hyundai, bolstered by its marketing strategy and the popularity of the Mustang Mach-E. Ford’s inventory of the Mach-E reached approximately 11,000 units, indicating a strong entry into the EV sales race. Volkswagen’s ID.4 also saw its advertised inventories double since the beginning of the year, while the Chevrolet Bolt dropped to fifth place in terms of inventory among BEVs.

Battery-Electric Vehicle Inventory

Ford Ramping up F-150 for Summer

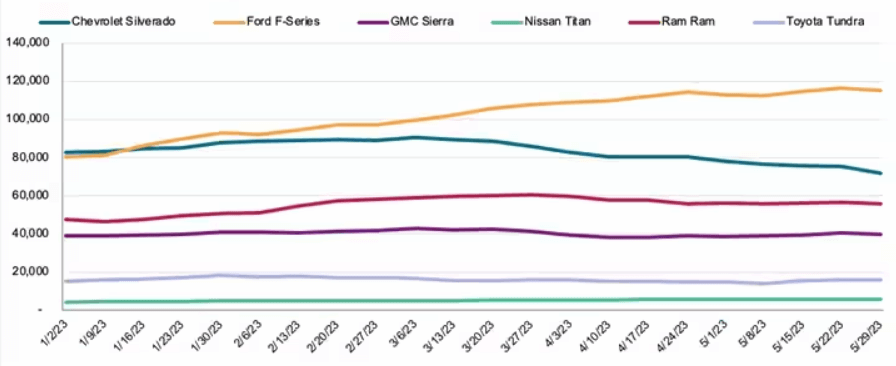

The full-size pickup market is witnessing notable developments, with Chevrolet experiencing a decrease in inventory following production brakes in its Fort Wayne plant. In contrast, Ford’s full-size pickup inventories have steadily climbed to 115,000 units, reflecting the brand’s robust sales performance. Ram continues to maintain relatively lower inventories, and GMC’s premium-branded pickups are gaining ground, posing a challenge to Stellantis’ truck brand.

Full-Size Half-ton Pickup Inventory

Looking Ahead

As the summer selling season approaches, the automotive industry faces the complex task of managing surging inventories while navigating availability challenges. How automakers tackle these circumstances will determine who gains an edge in the highly competitive market. With shifting trends in compact luxury utility vehicles, the rise of non-Tesla EVs, and the battle for dominance in the full-size pickup segment, the coming months are poised to bring forth intense competition and potentially lucrative incentives to secure market share. Stay tuned as the auto industry continues to evolve, providing exciting opportunities for both consumers and manufacturers alike.