The UAW Strike is Underway, Impacting the Big Three (PDF)

Auto workers from the “Big Three” automakers have initiated a strike, shaking up the automotive industry. This protest by the United Auto Workers (UAW) union targets Ford, General Motors, and Stellantis, with the strike officially commencing at 11:59 p.m. ET on Thursday, September 14.

Initially, the strike’s immediate repercussions may manifest in the form of discontinued incentives for consumers. Inventory shortages are anticipated, leading to an uptick in used car prices.

Update as of September 15, 2023

Approximately 13,000 UAW members began protesting as their contracts with Ford, General Motors, and Stellantis expired. The strike’s outset is described as “tactical,” starting with three assembly plants:

- Ford’s Michigan Assembly in Wayne, Michigan, where Bronco and Ranger production currently takes place.

- General Motors’ Wentzville Assembly in Wentzville, Missouri, is responsible for producing Chevrolet Colorado and GMC Canyon vehicles, among others.

- Stellantis Toledo Assembly Complex in Toledo, Ohio, which manufactures the Jeep Wrangler and Gladiator.

UAW President Shawn Fain has indicated that if an agreement isn’t reached promptly, more plants may be affected. Fain expressed the union’s readiness to escalate the strike if necessary.

As of now, Ford has not publicly responded to the objection, although its Vice President of Communications issued a statement before the strike, referring to Ford’s being known for their generosity throughout history. General Motors said they were disappointed with the UAW leadership’s actions, but they remained committed to bargaining for a fair contract that benefits all workers. Stellantis also expressed disappointment and declared their intent to protect their North American operations.

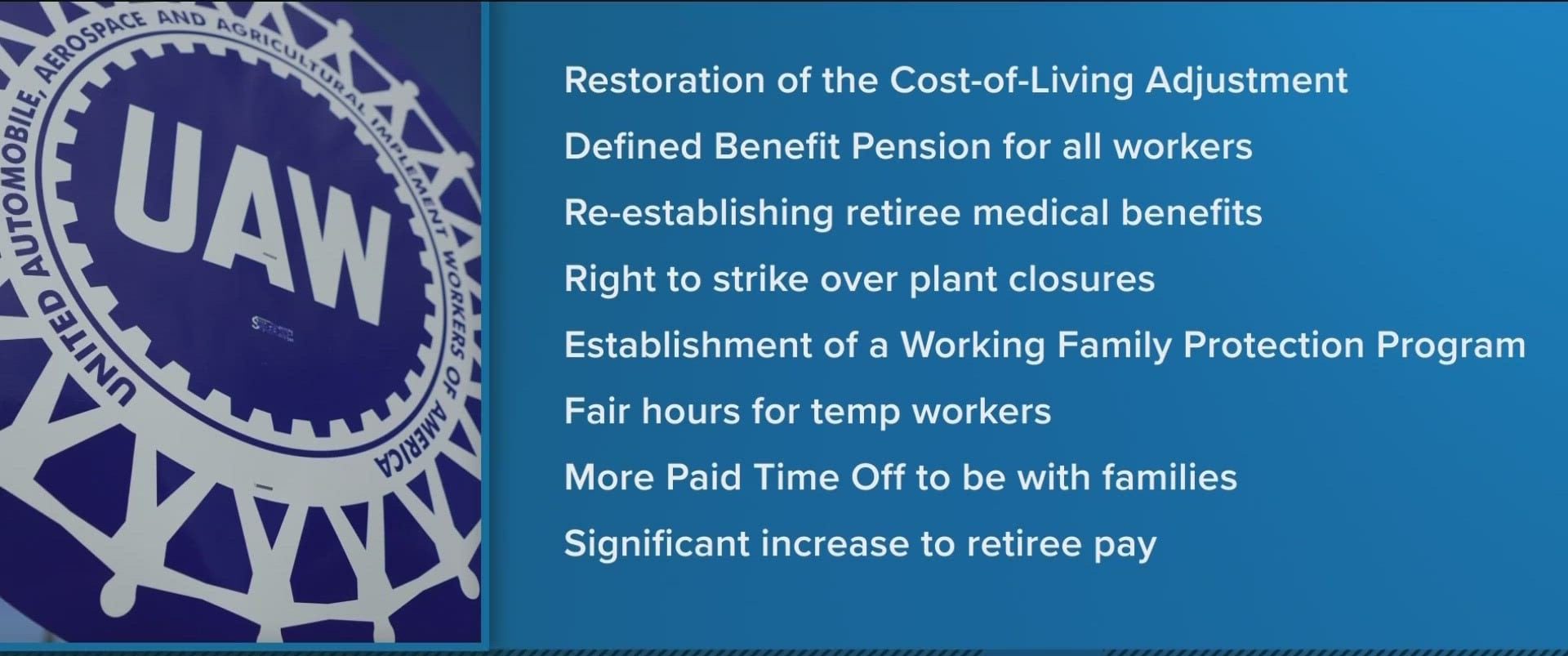

UAW’s Strike Demands

This strike holds the potential to be more extensive and protracted than the previous United Auto Workers strike four years ago, which affected nearly 50,000 General Motors workers for six weeks. The UAW’s current demands include a substantial wage increase over the next four years and a shorter 32-hour workweek, while the automakers have presented counteroffers that have been criticized by the UAW.

Automotive supply chain expert Ambrose Conroy suggests that a strike is highly likely at this point. The key questions revolve around which automakers will be impacted and whether it will be a limited, tactical strike aimed at extending the UAW strike fund. The $825 million strike fund could last around 90 days, but if the strike selectively targets critical factories, it could endure much longer.

This strike occurs at a crucial juncture when manufacturers are beginning to regain momentum in dealer inventory and production. While some supply chain challenges persist, used car prices are stabilizing, and new car incentives are resurfacing. Increased inventory levels have led to a rise in incentives, albeit still below pre-pandemic levels.

According to Cox Automotive’s data, the average supply of new, unsold vehicles in dealer inventory is currently 58 days, marking a 46 percent increase from the previous year.

Automakers’ Preparedness

Stellantis and Ford have not disclosed details about their dealer inventories or whether they’ve taken proactive measures to mitigate strike-related risks. In contrast, GM’s Director of Finance and Sales Communications, David Caldwell, described GM’s U.S. inventory as “consistent,” with only a 4 percent increase compared to the first quarter.

While the comparisons to past years reflect improvements in production and availability, it’s important to note that the industry has faced supply chain disruptions in recent years.

Anticipating the Impact of the UAW’s Strike on Incentives

The UAW has refrained from commenting on the likelihood or scope of the strike. Nevertheless, Ambrose Conroy of Seraph Consulting believes that consumers may experience swift consequences.

Incentives are expected to vanish shortly after the strike begins, urging potential buyers to act promptly if they seek deals. Automakers are likely to prioritize the production of their highest-profit vehicles, causing on-hand inventory to deplete rapidly. Once these inventories run dry, shortages may affect the broader market, potentially driving up used car prices, especially if the strike extends beyond 30 days.

Simply put

A prolonged strike could lead to a resurgence of secondhand price volatility.

For more news and information on the automotive market, stay tuned to our website.