[easy-pricing-table id=”1215″]

MAXIMIZE YOUR TOTAL LOSS SETTLEMENT IN 3 STEPS

-

Did the insurance company declare your vehicle a total loss?

-

Is the Actual Cash Value offered by the carrier unfair or too low?

-

Are you frustrated and unhappy with how your total loss claim is going?

You’re not alone, thousands of vehicle owners find themselves in this situation every year. The difference is, you’re smarter than the 95% and you’re trying to do something about it.

How you can get more money for your totaled car

The answer is simple, by law you are entitled to challenge the insurer’s offer. You can reject it and give them a counter-offer.

Our website is designed to help you get a higher settlement by negotiating a higher value.

By law, carriers are required to handle claims in good faith and consider written evidence submitted in a claim. An appraisal report is the evidence you need in a total loss claim dispute.

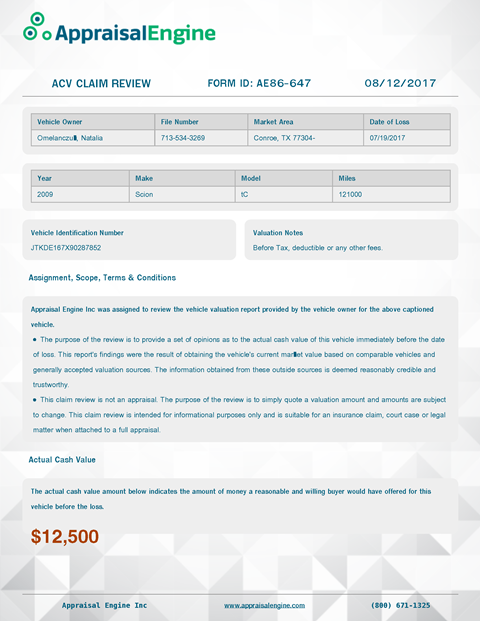

1⃣ Order a Claim Review

First, we need to make sure you have a viable dispute on your hands. Many clients think their vehicle is worth more than the market value, that is why we offer a claim review or a value quote.

This document shows what the forecasted value of your vehicle is. It is not a full appraisal but will give you an idea if your claim is worth pursuing or not.

The cost of the claim review is $75 and you can order it here: Order a Total Loss Claim Review

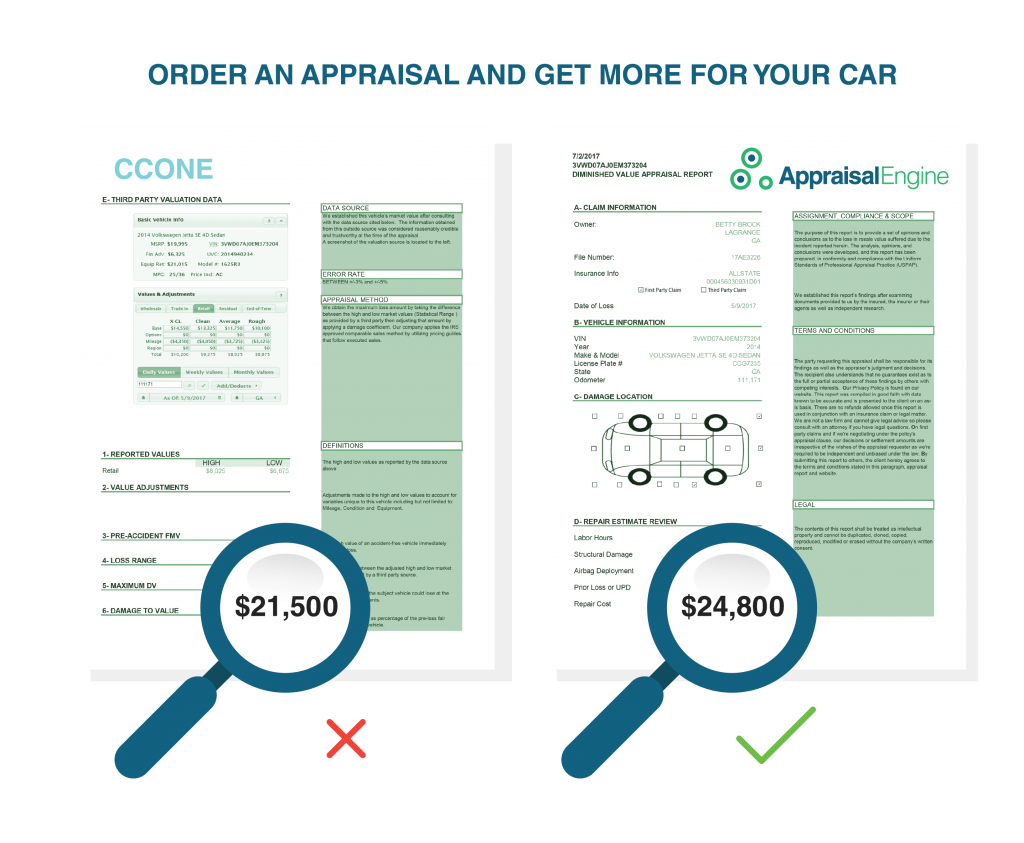

2⃣ Order an Appraisal Report

Once you’ve ordered a claim review and received results that would move your claim forward (the value quote is higher than the insurer’s offer), you can then order a full appraisal.This appraisal is 5 pages long and follows the IRS-approved comparable appraisal method.

Our Total Loss Appraisal will include the following:

- Vehicle Description

- Vehicle Condition Grade

- Comparable Vehicle Listings

- Value Adjustments

- USPAP Compliance Statements

- Appraiser attestation and Signature

The cost of this appraisal is $175.

Click here to order a Total Loss Appraisal

Click here to pay for a full appraisal if you’ve already received a claim review

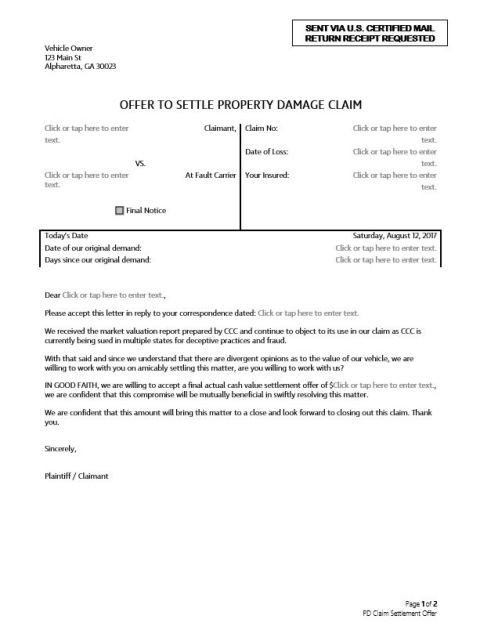

3⃣ Submit Appraisal and Demand Letter to Insurer

After you’ve ordered the report, you will submit it to the carrier along with a total loss demand letter.

On first party claims, your appraisal clause will kick in, we will then negotiate with the insurance company appraiser and settle the claim for you for a nominal cost of $125.

Some cases require extra time and additional charges may apply (up to $250).

Please Note: We never take a percentage out of your settlement, you will receive funds directly from the carrier.

PLEASE NOTE:

If you’re filing a claim under your policy, the appraisal clause provisions might be invoked by your carrier.

If this happens, we offer total loss settlement services to assist you further.

TOTAL LOSS SERVICES – APPRAISAL ENGINE INC.

GET STARTED TODAY WITH A CLAIM REVIEW

Actual Cash Value Claim Review

Not sure if the insurer is offering you a fair deal? Fill out the form below and order our Total Loss claim review. We will advise as to the correct actual cash value of your vehicle so you can submit the report to the insurance company to receive fair compensation. Complimentary, no-obligation, Total Loss claim review.