Total Loss Claims for Flooded Vehicles.

- Was your vehicle in a flood or water damage?

- Do you know what you should do if your car is flooded?

- Is your insurance company fairly compensating you for your vehicle’s value?

Every year thousands of vehicles are totaled due to flood, and with a busy hurricane season ( super storm – Hurricane Sandy), many vehicle owners are finding themselves in a situation where they need to buy a new car. But is the insurance company paying you enough for your flooded car?

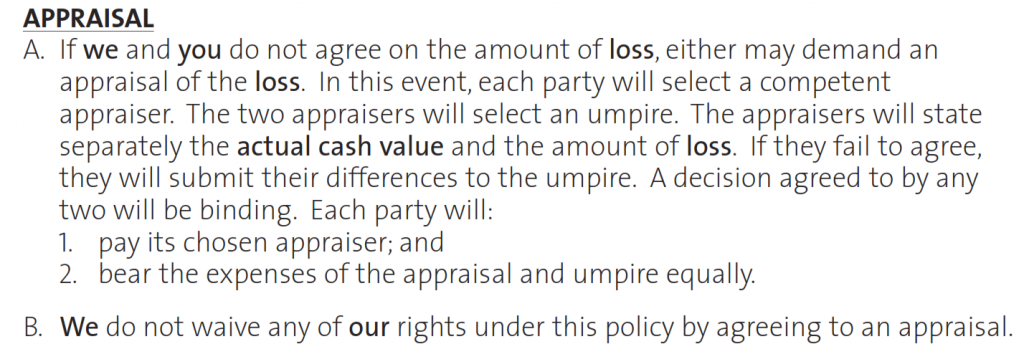

Most insurance policies have an appraisal clause in them. The appraisal clause states the following:

If we and you do not agree on the amount of loss, either may demand an appraisal of the loss. In this event, each party will select a competent appraiser. The two appraisers will select an umpire. The appraisers will state separately the actual cash value and the amount of loss. If they fail to agree, they will submit their differences to the umpire. A decision agreed to by any two will be binding.

Auto Flood Claim Processing:

As you can see, you policy has provisions that ensure the proper processing of your claim. Most insureds have no idea this appraisal clause exists in their policy and believe that the amount offered by the insurance carrier is final and binding.

What we do: As licensed auto appraisers we help you present to your insurer an alternate appraisal. Keep in mind, you need to have comprehensive coverage (full coverage) policy in order to get paid for your flooded vehicle. Our vehicle valuations are industry standard and are USPAP compliant.

To order an appraisal from us, please start by answering this questionnaire.