Total Loss Case Study, Hyundai Sonta, Atlanta Claim

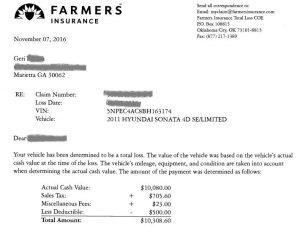

We were contacted by Geri, P from Marietta, GA. Her insurance company, Farmers, had offered her $10,080 as the cash value of her 2011 Hyundai Sonata Limited.

Geri contacted us asking for a quote, she wanted to know if her insurance company was giving her a fair offer.

First, we requested a copy of the appraisal report Farmers was basing their offer on. Apparently, CCC was the company they hired.

After a claim review, we told Geri that the Actual Cash value was in fact closer to $12,000 and not the $10,080 she was being offered. Geri ordered an appraisal from us.

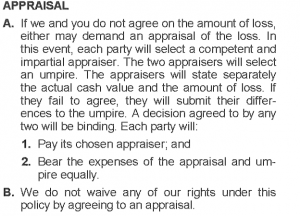

Geri submitted our appraisal to her carrier and invoked her appraisal clause.

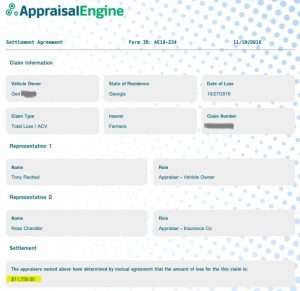

After being contacted by the insurance company’s appraiser, we were able to settle Geri’s claim for $11,750.

Case Study Summary:

| Original Offer | $ 10,080 |

| Appraisal | $ 11,989 |

| Settlement | $ 11,750 |

| Increase | $ 1,670 |

| Increase Percentage | 17% |

| Appraisal Cost | $ 150 |

| Return on Investment | 1013% |

Was your car totaled? We can help.

Total Loss Written Claim Review

Not sure if the insurer is offering you a fair deal? Fill out the form below and order our Total Loss written claim review. This will be the best $75 you'll ever spend.

"*" indicates required fields