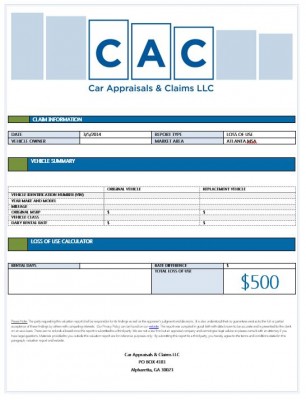

Did you get a rental that’s lower in value than your damaged vehicle? Collect the difference between what your car’s daily use is worth and the rental car.

What is the Loss of Use Calculator?

Our loss of use valuation tool helps you recover the full amount of your claim by comparing the rental rate between the vehicle provided to you as a replacement and the actual usage value of your vehicle.

Example:

- Damaged Vehicle: 2013 Volvo XC60 with premium and technology package, Original MSRP $43,000, rental rate $75 per day

- Rental Vehicle: 2013 Ford Escape with cloth seats. Original MSRP $24,000, rental rate $30 per day

- Rental Period: 20 days

- Loss of Use: ($75-$30) X 20 = $900

In this case, after your car is repaired you would send the at fault carrier our Loss of Use valuation report and ask for compensation.

It is very important to demand a vehicle EQUAL to yours from the beginning, if one is not available, make sure you make a point of indicating your dissatisfaction and inform the adjuster of your intent to pursue a loss-of-use.

Loss of Use Calculator

This calculator is designed to compute the difference between the rental rate of the damaged vehicle and the replacement vehicle.